Are you feeling the impact of inflation?

THE CONSTITUTION HAS THE ANSWER!

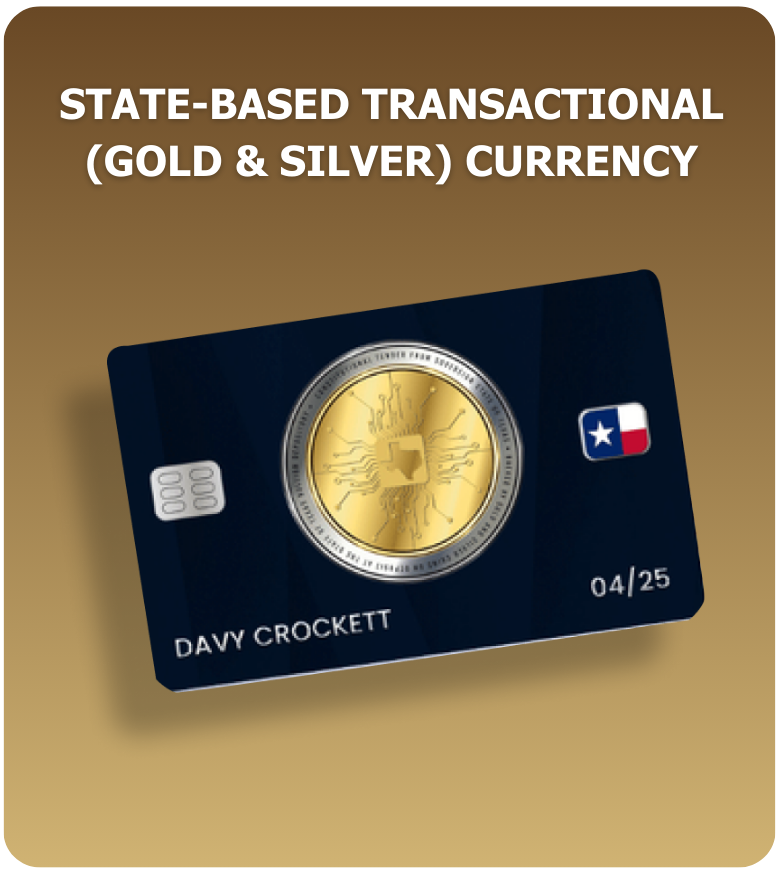

Combine existing technology with US Constitution Article 1, Section 10 and you have what we call

Transactional Gold

A debit card with fully electronic features like Apple Pay or Samsung Pay but issued by a state.

WHY DO WE NEED THIS?

- The dollar has lost over 90% of its purchasing power since getting off the gold standard in 1971.

- Now, the dollar is a strong currency compared to the other currencies in the world...But that’s honestly terrible.

- Gold and silver are a natural hedge against inflation; now anyone, not just the rich, can afford to own gold.

- With the current technology, you can purchase as little as $.01 worth of gold or silver, and spend it easily anytime you need it.

.png?width=550&height=600&name=Untitled%20design%20(76).png)

With Legal Tender State Legislation, Using Gold Every Day is Simple.

It is just another way to pay!

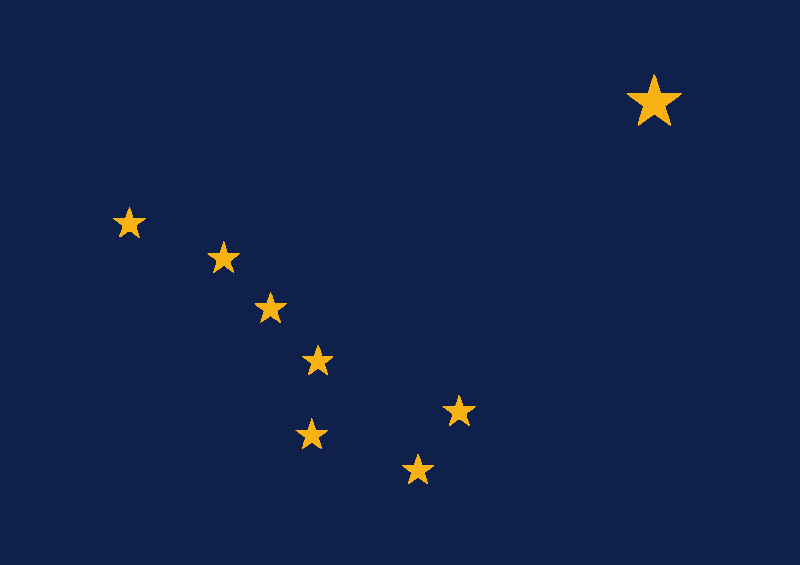

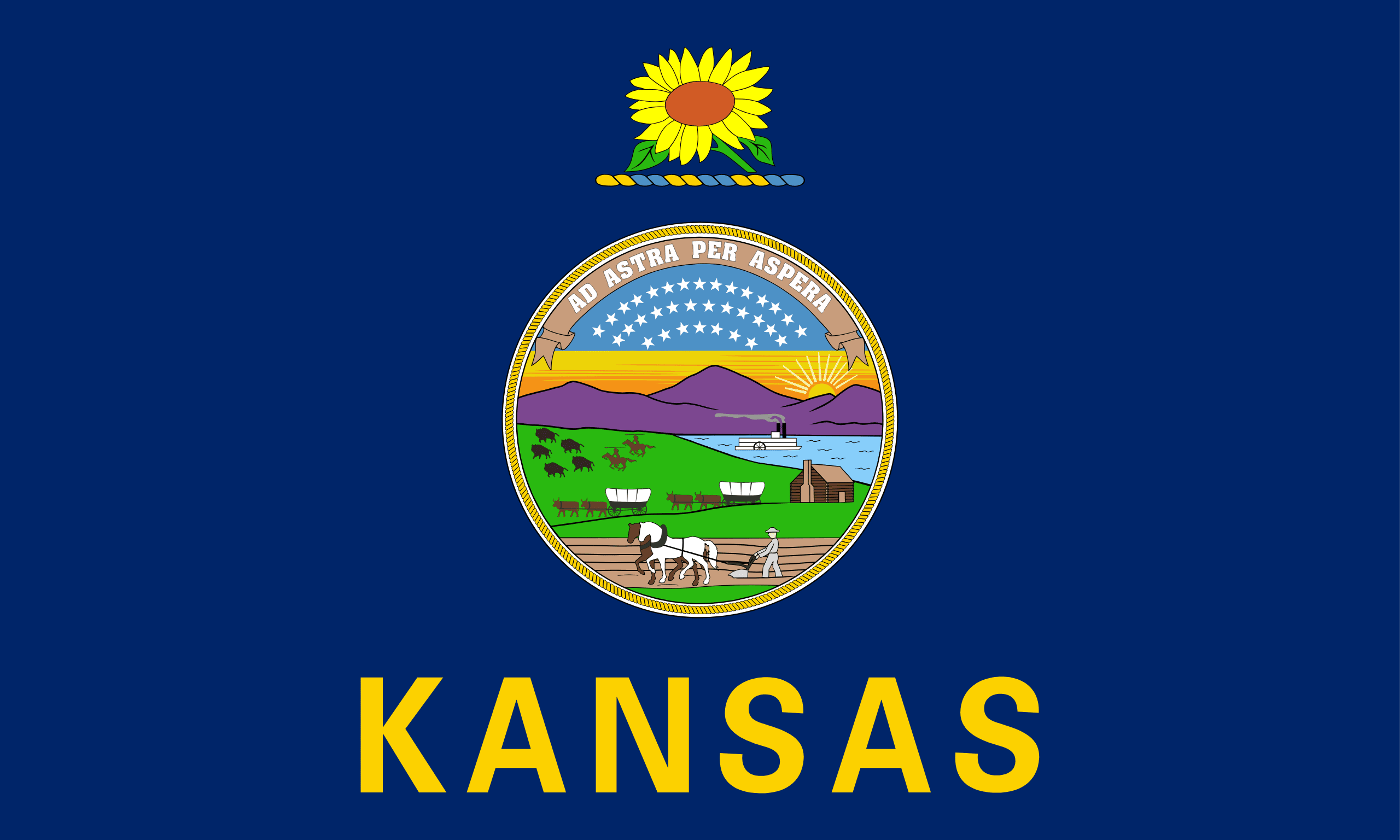

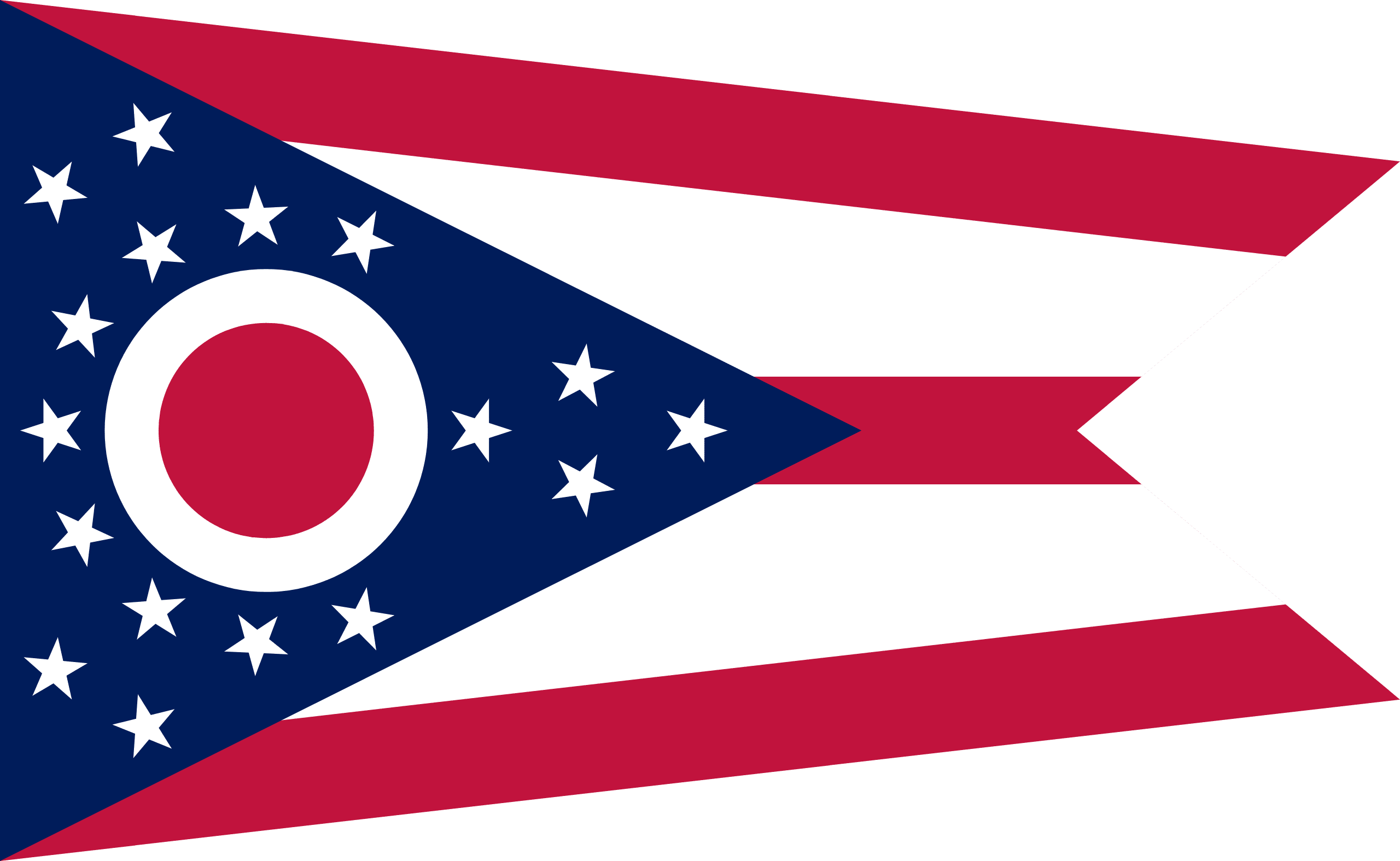

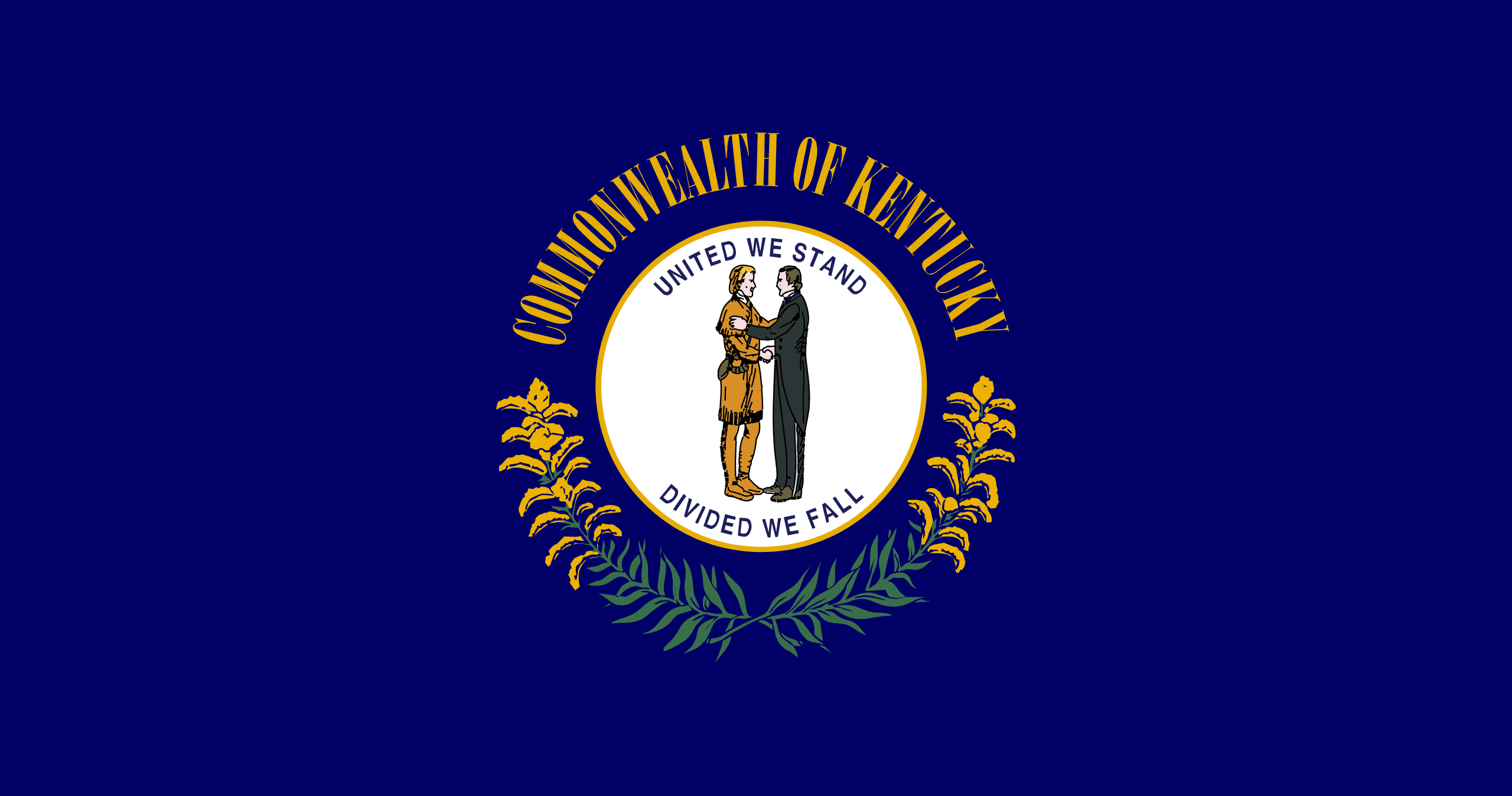

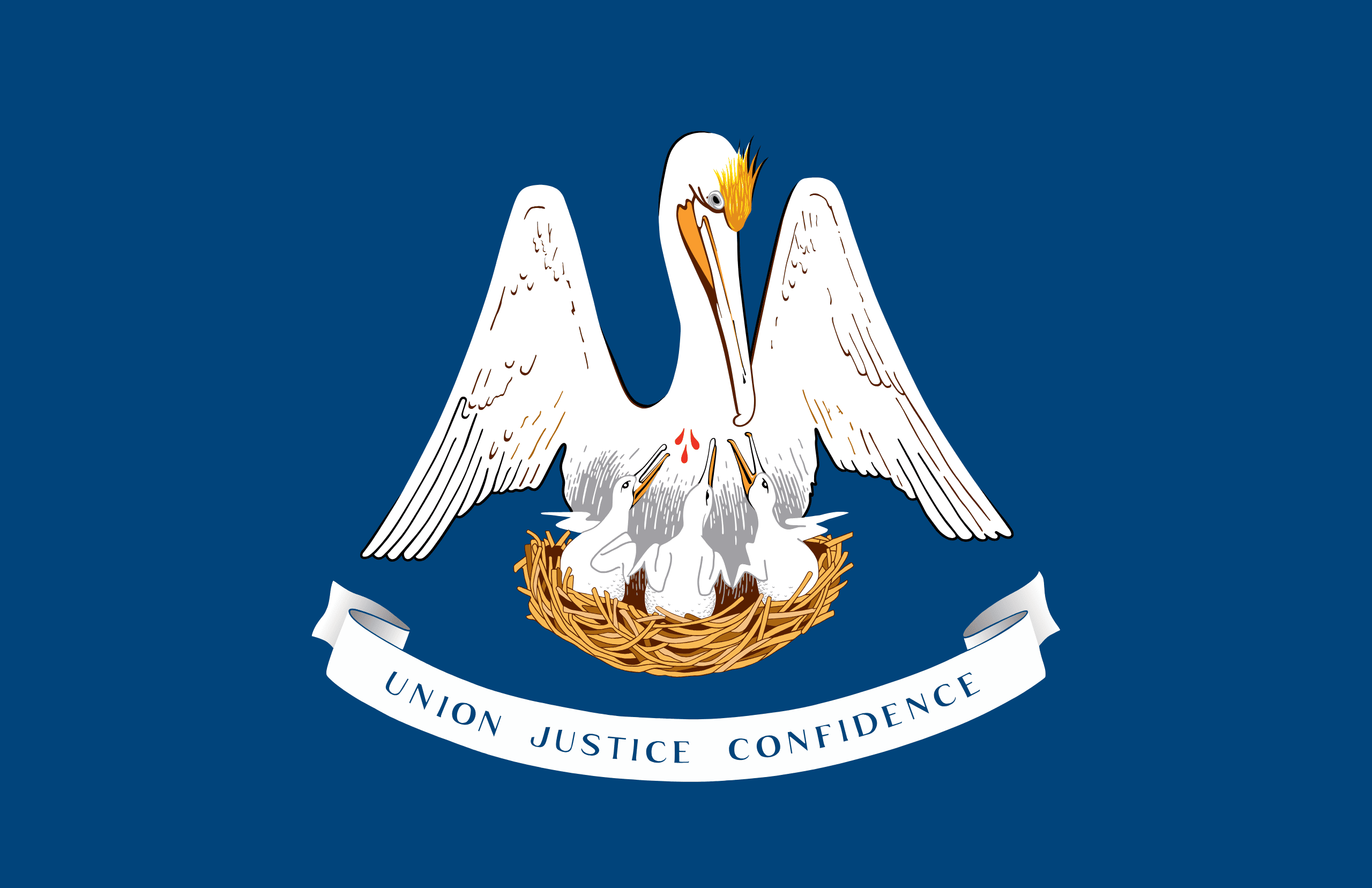

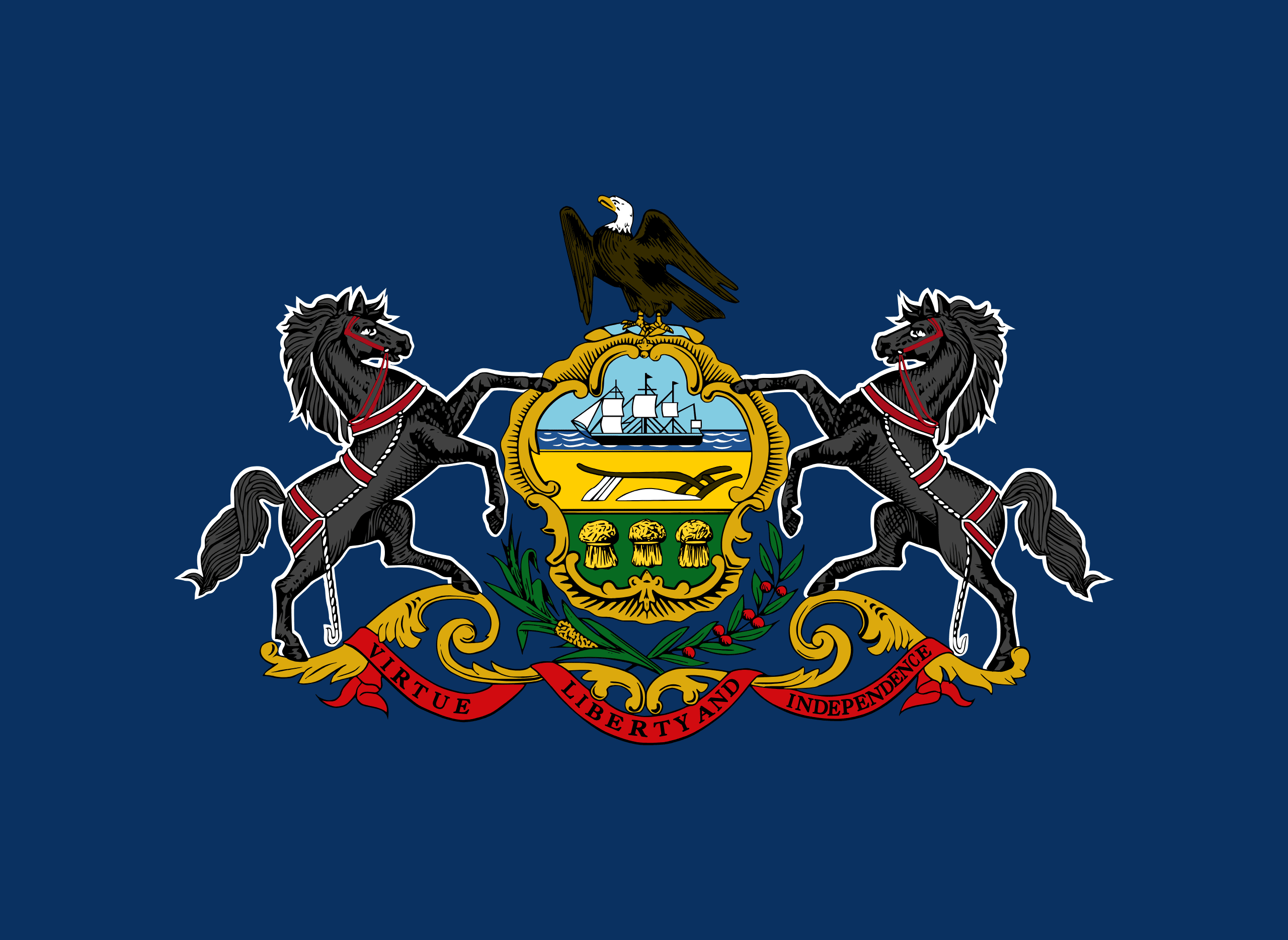

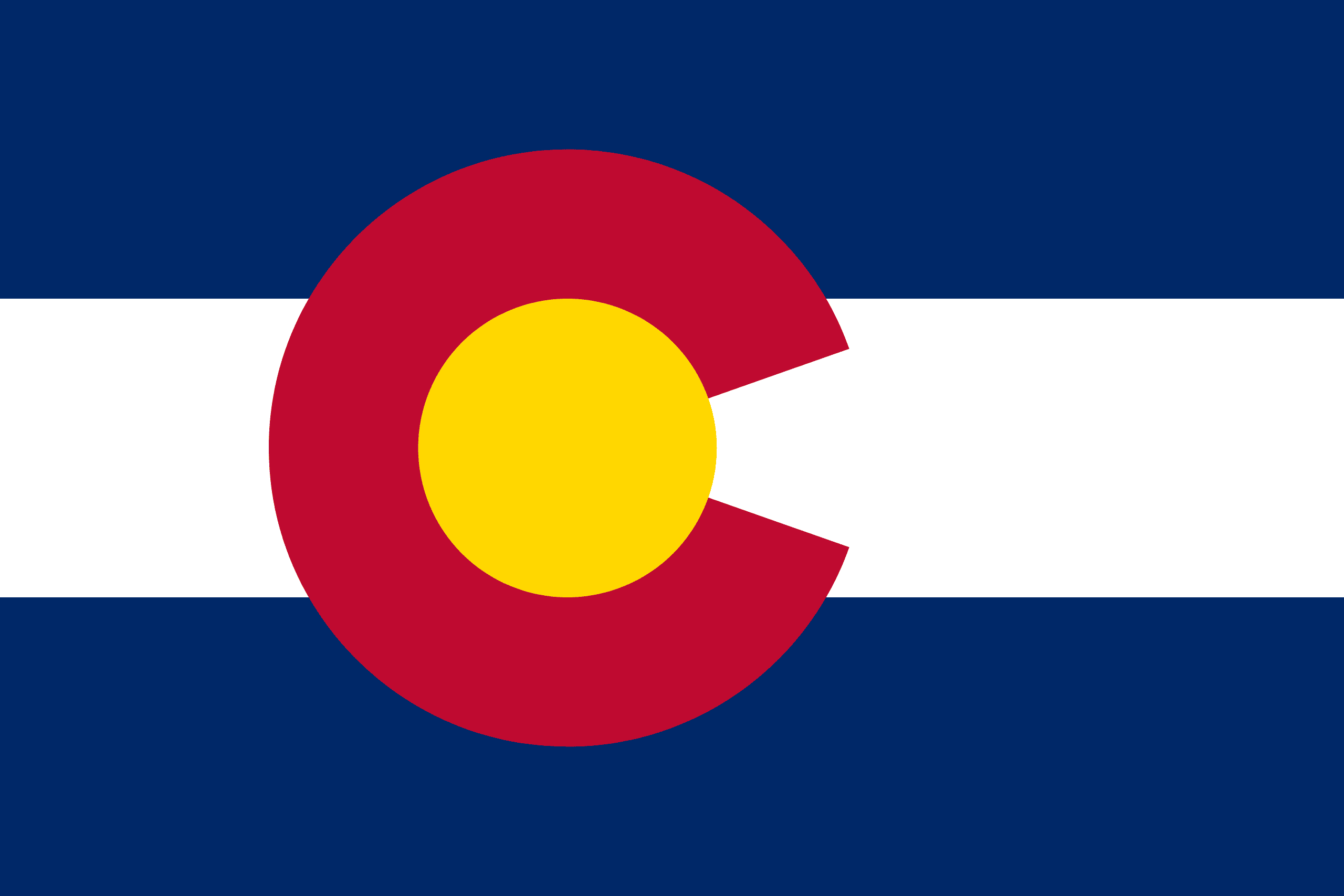

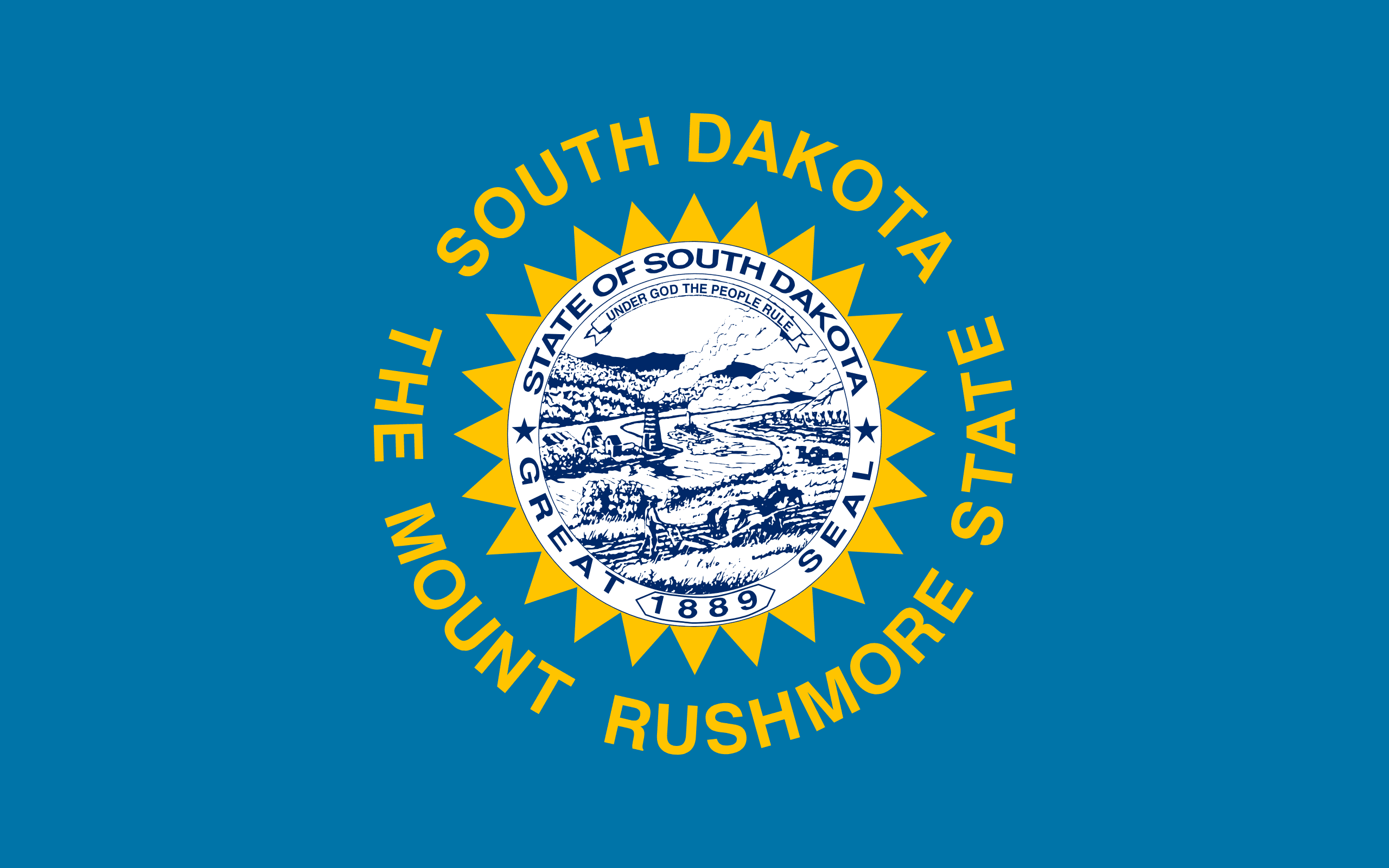

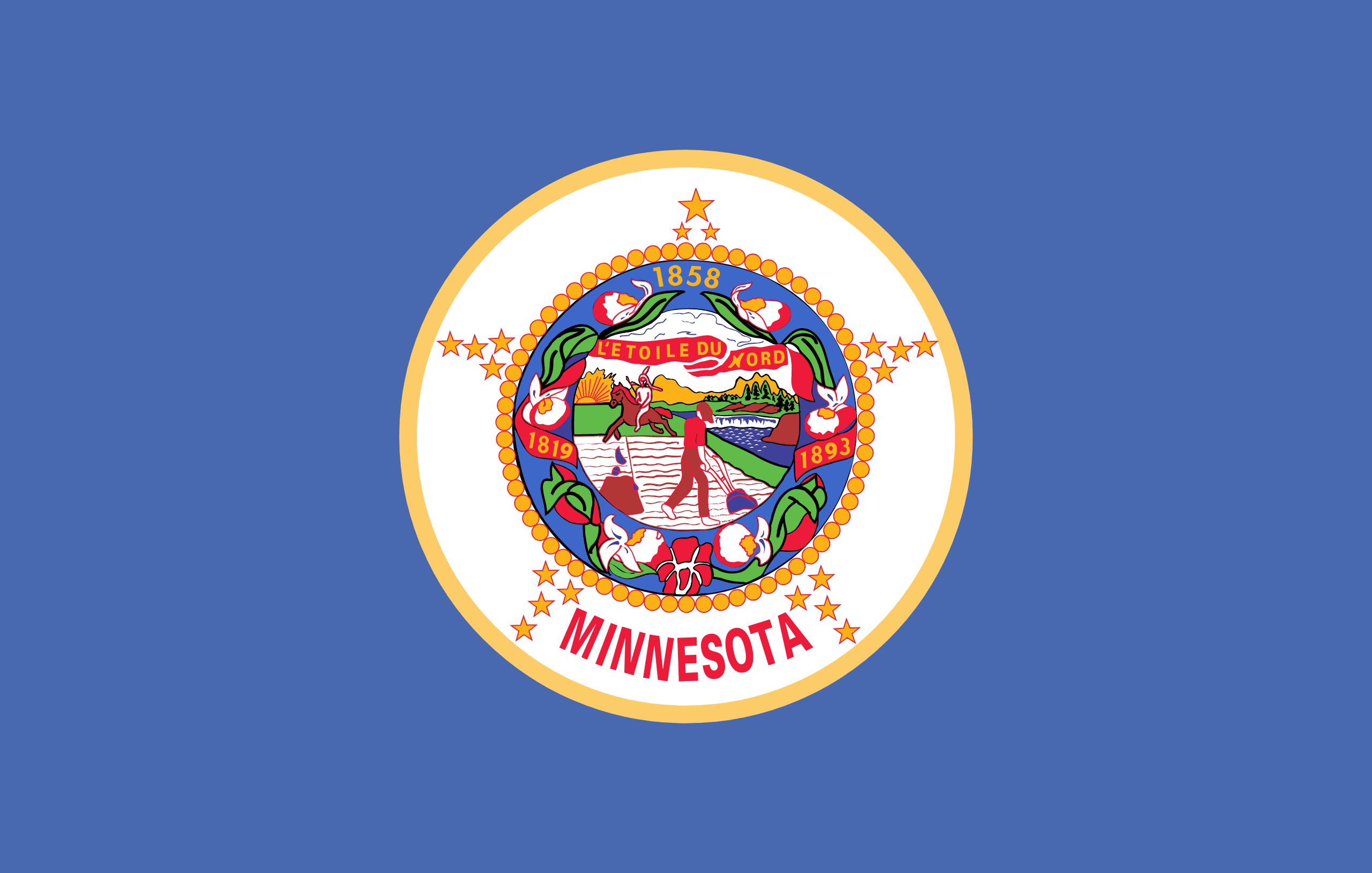

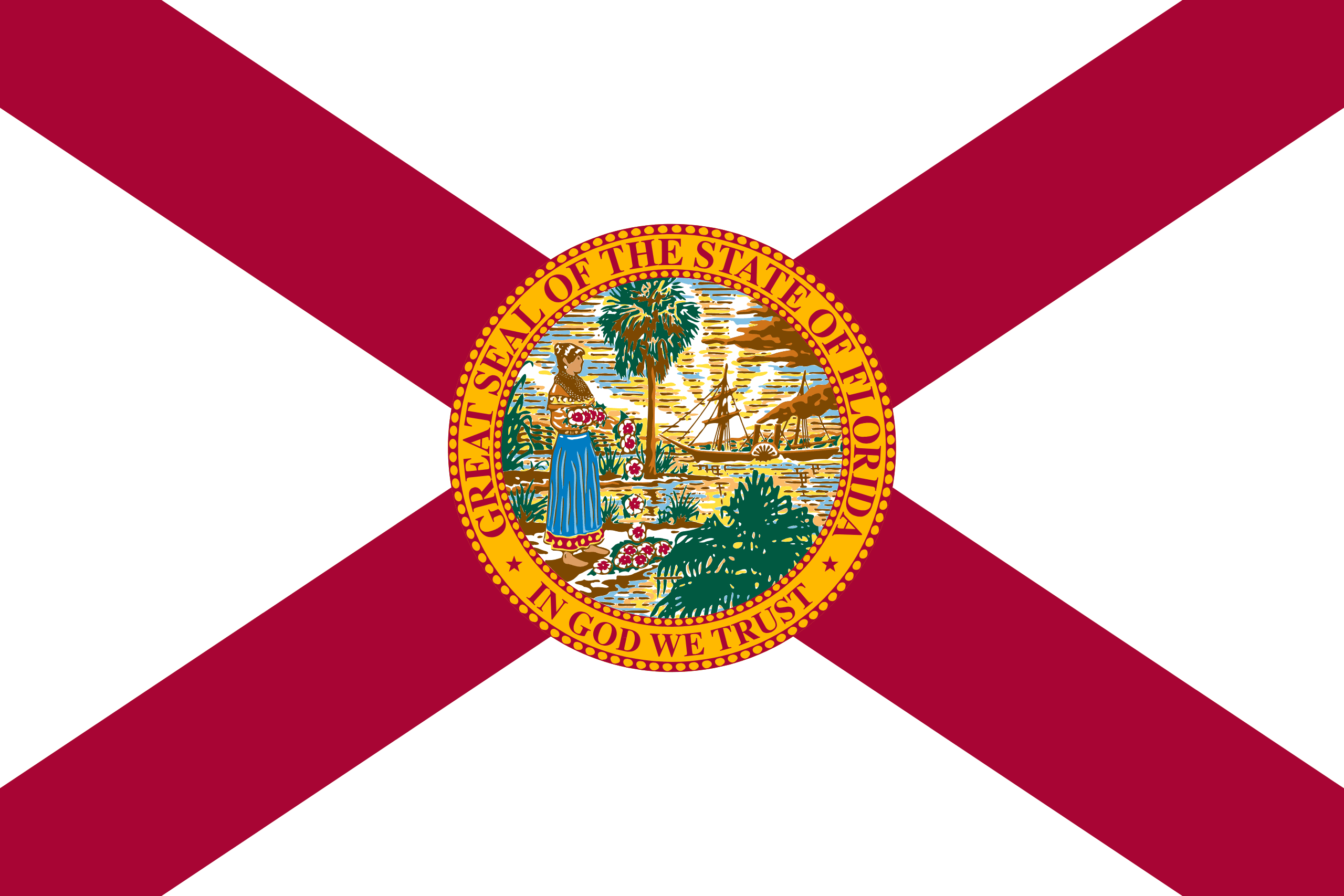

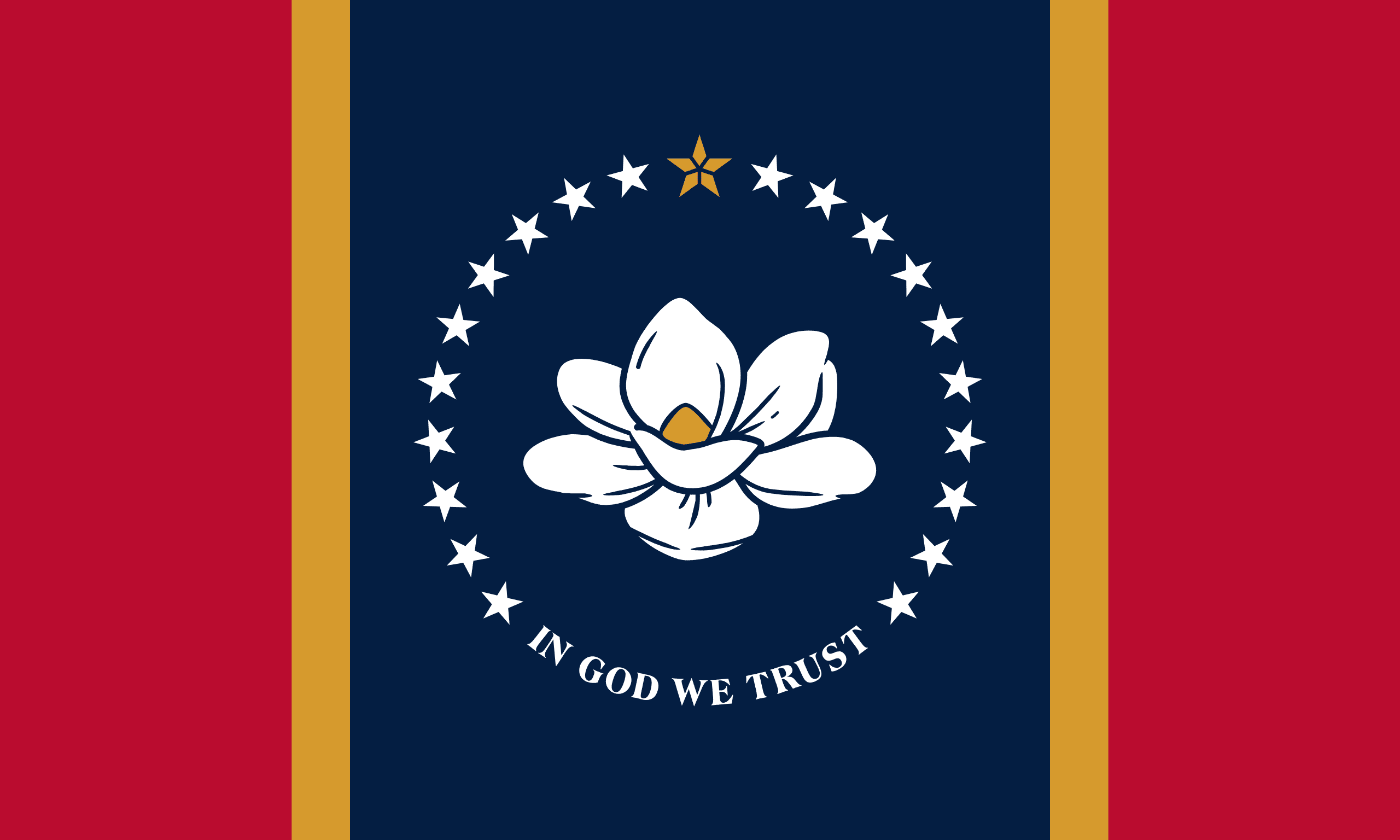

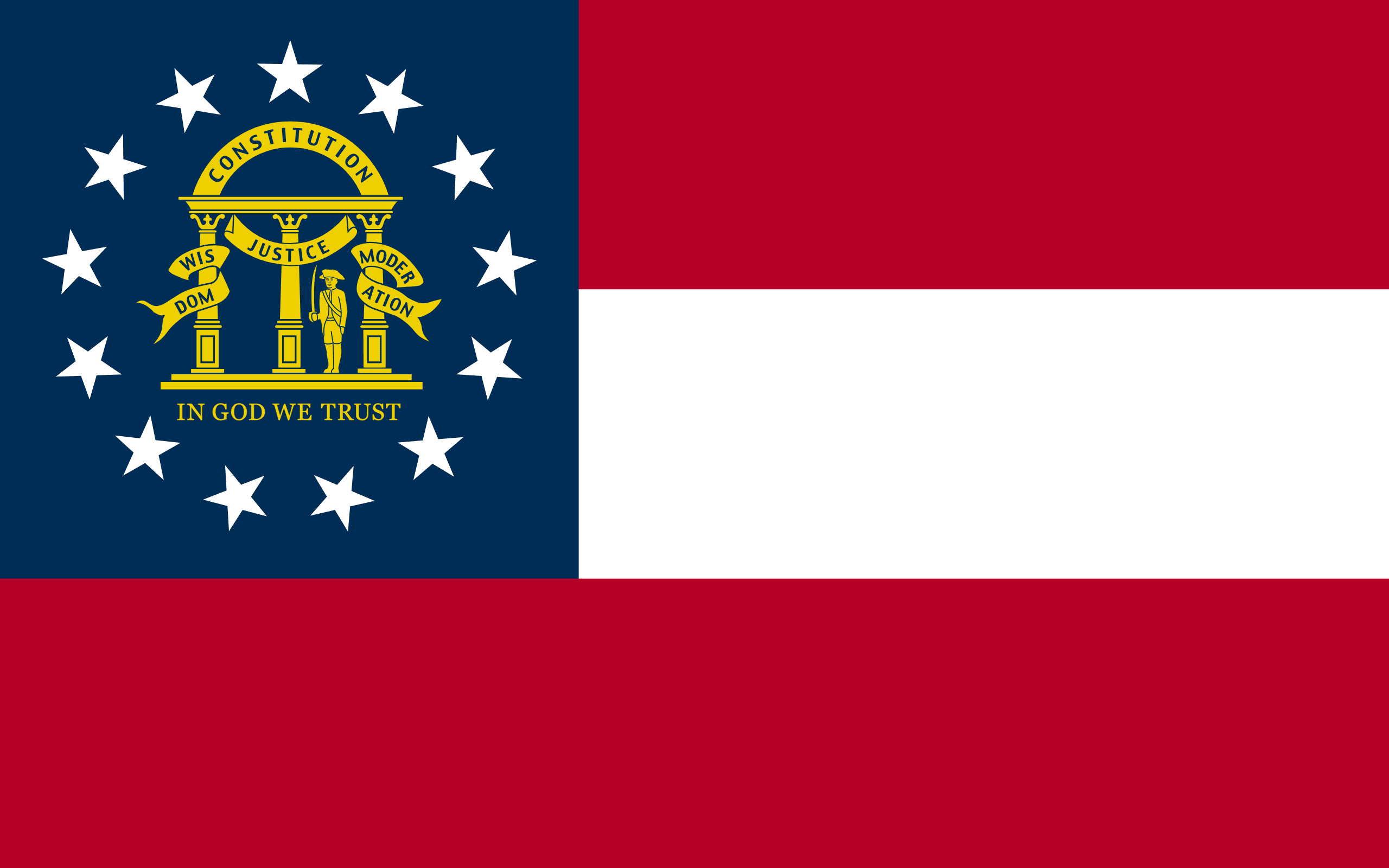

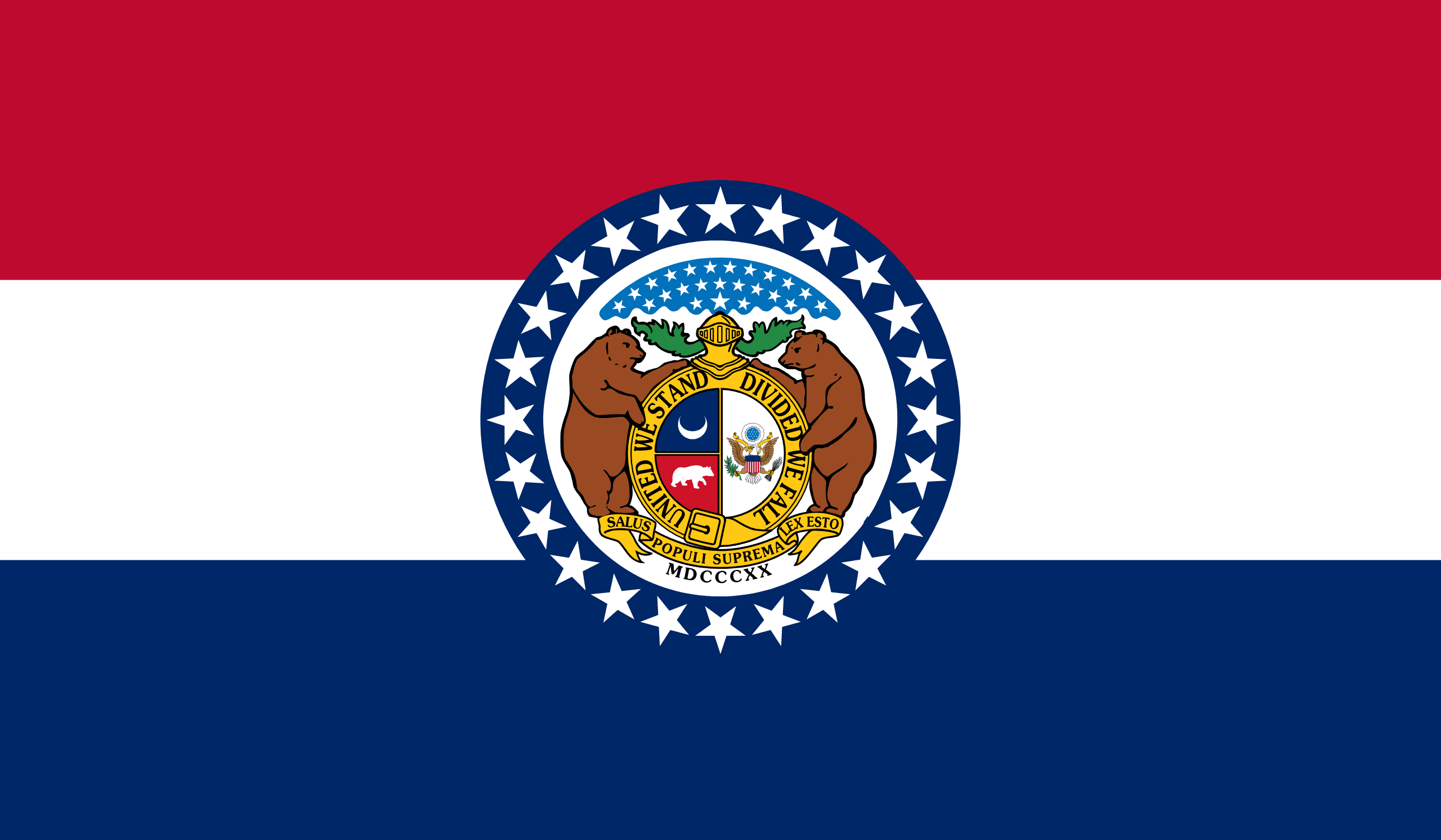

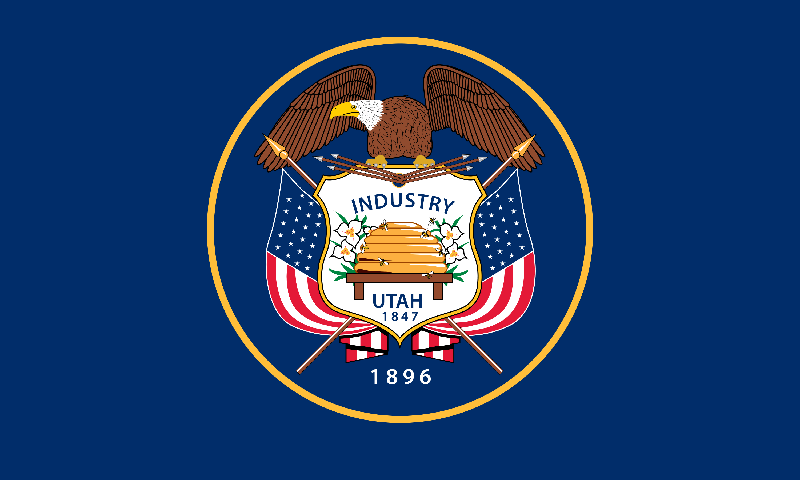

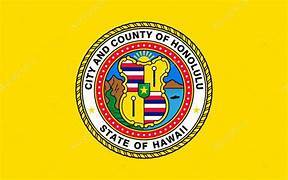

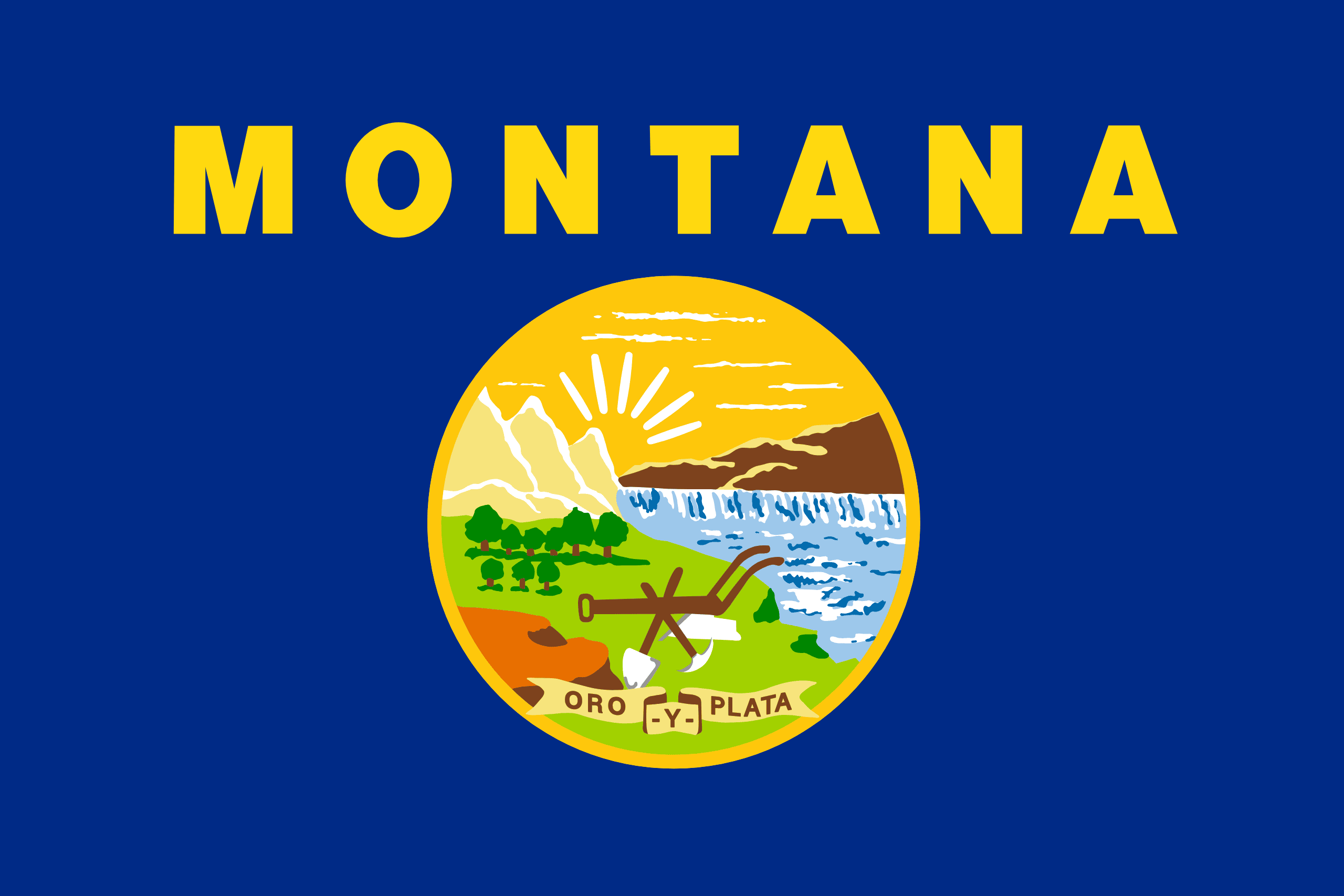

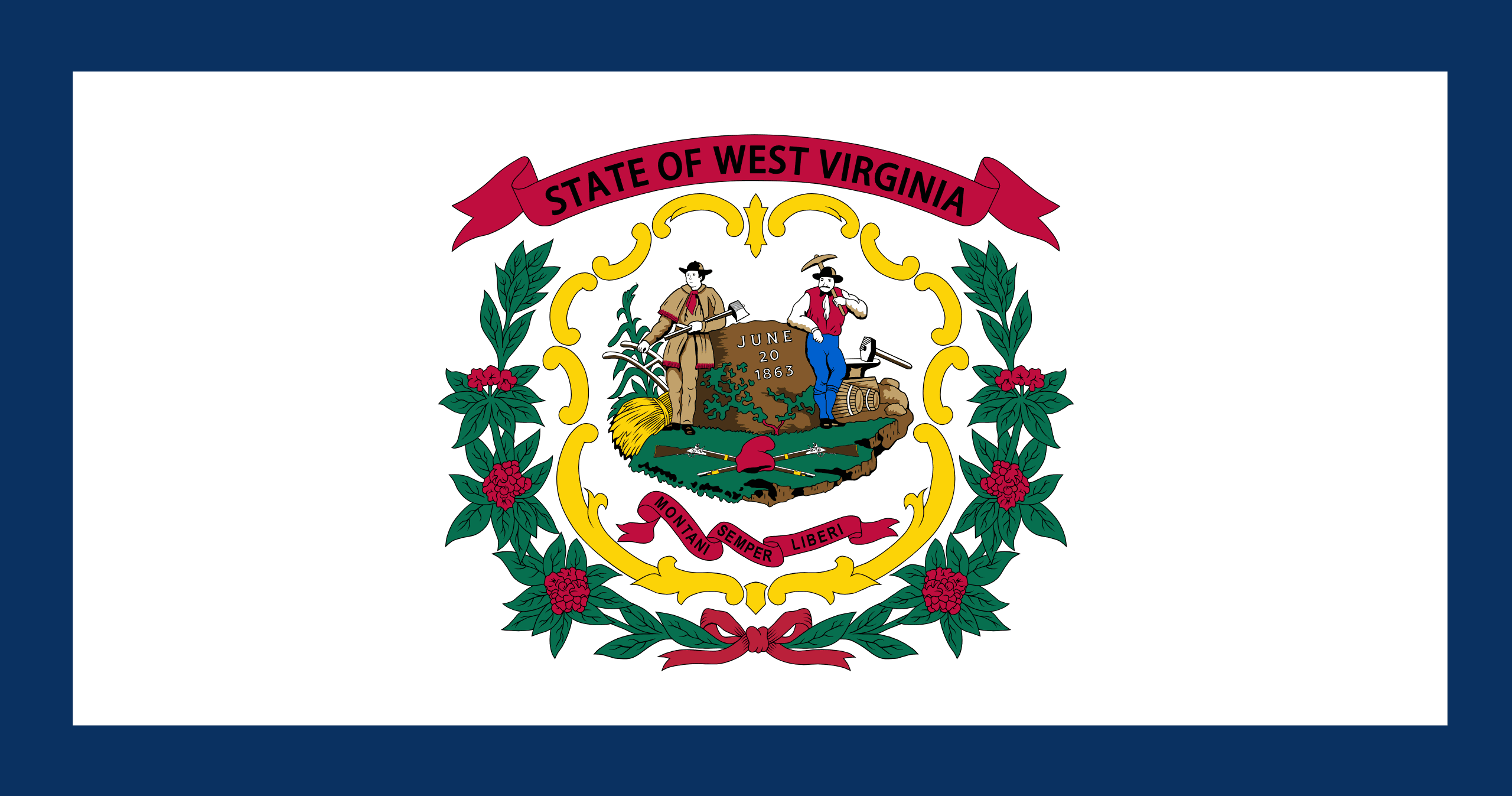

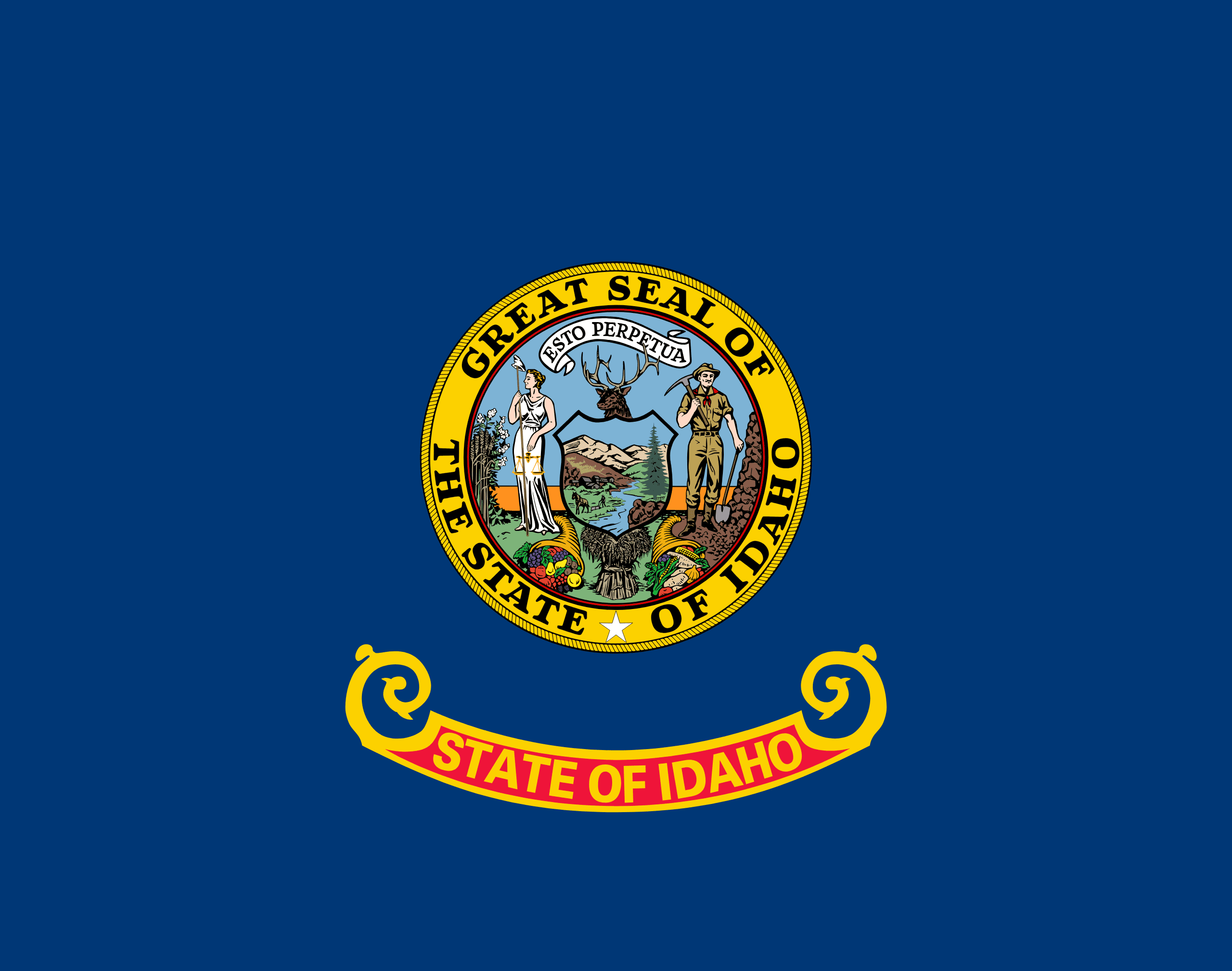

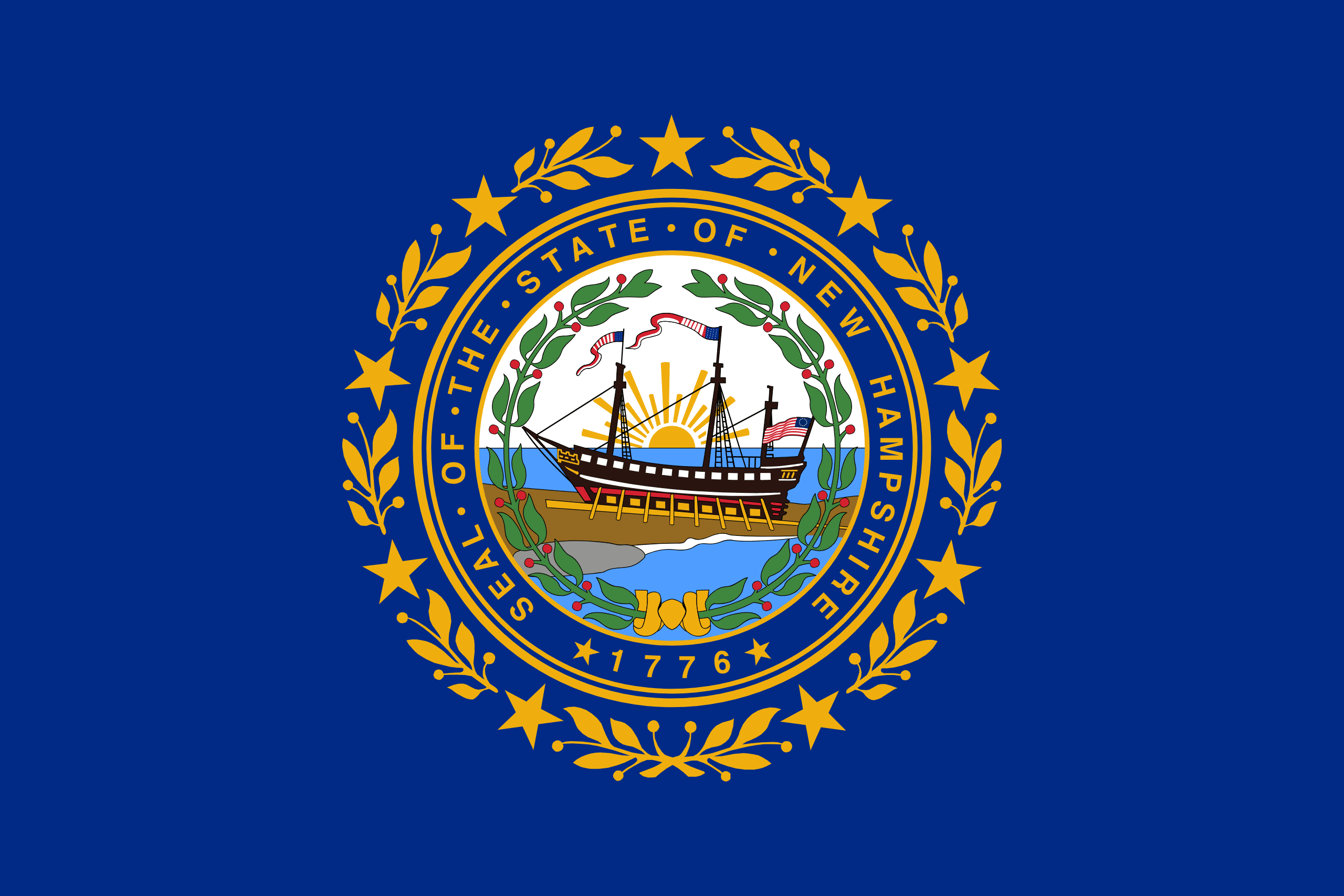

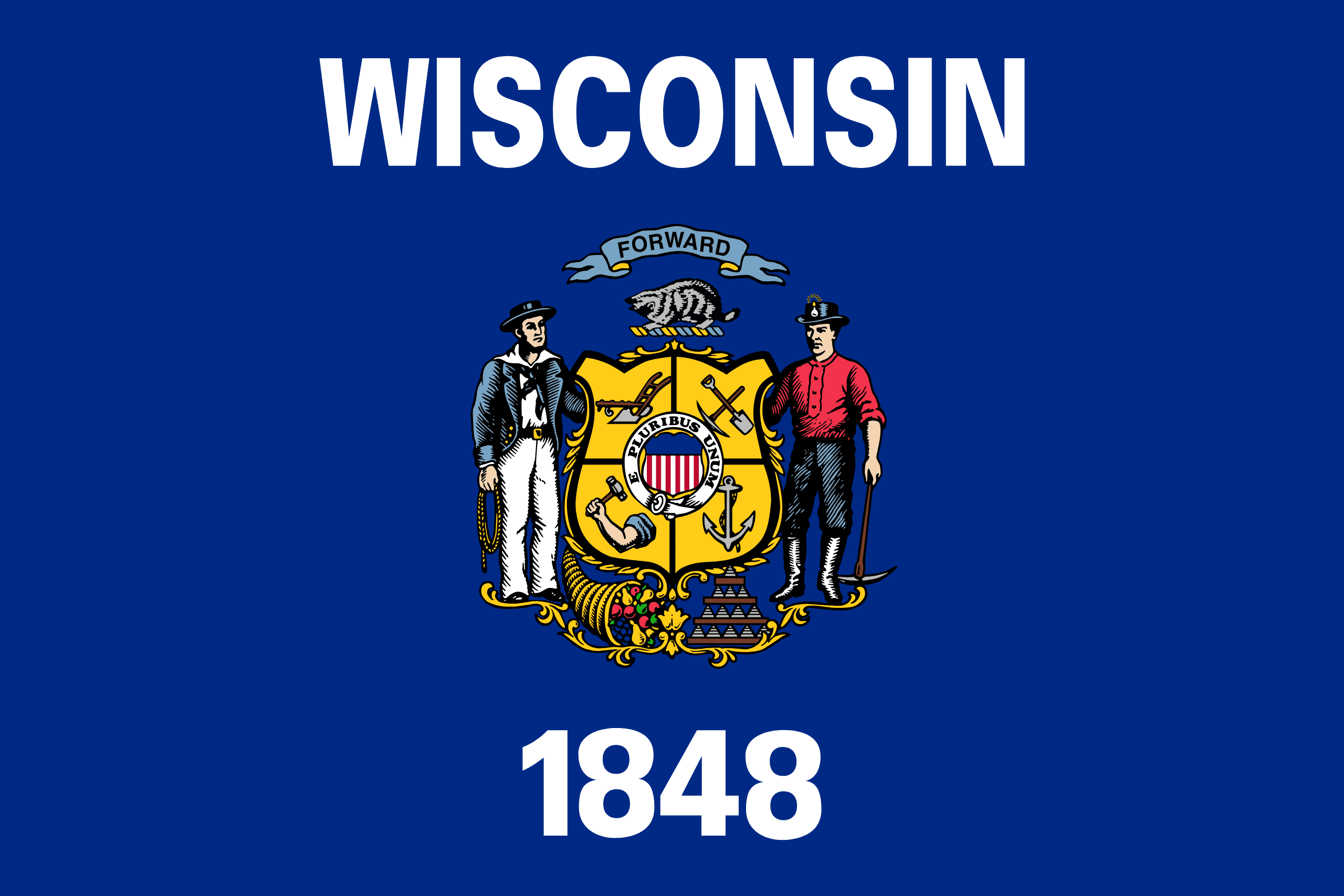

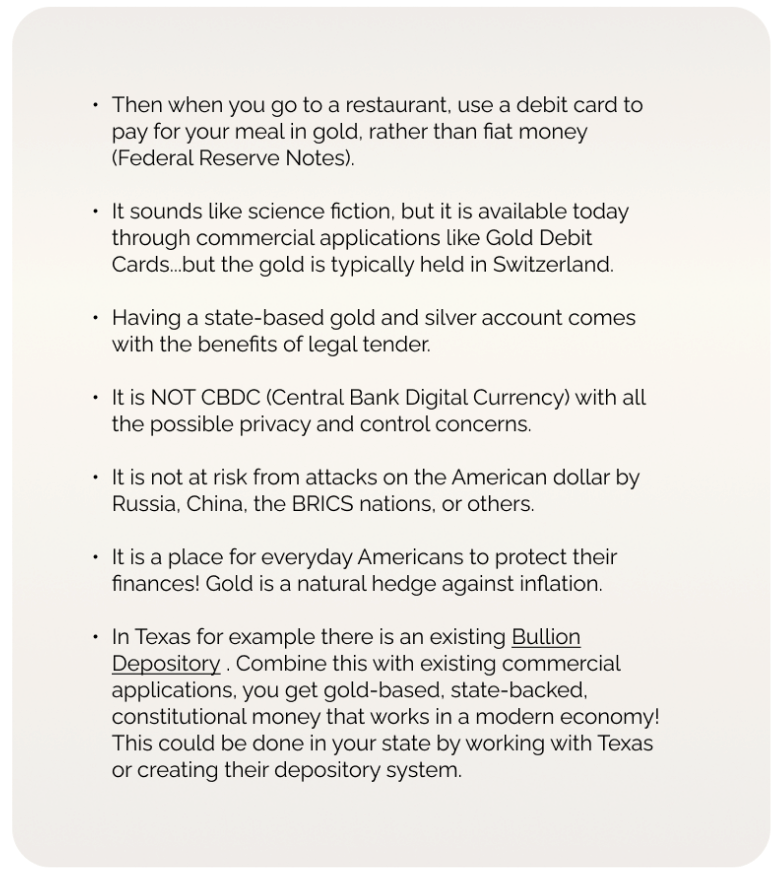

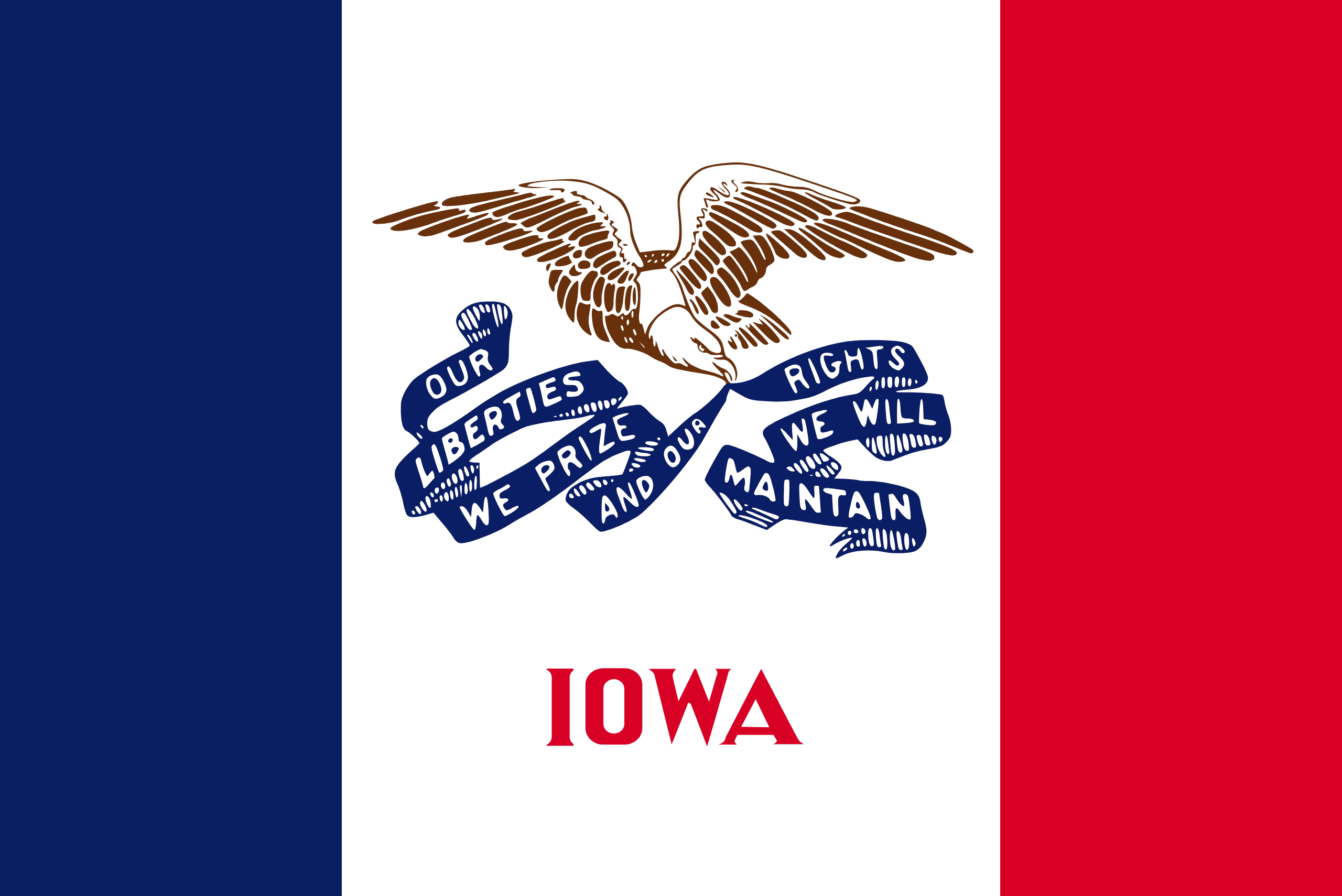

Active States

The Legacy of Gold & Silver as Money

Inspired by Kevin Freeman’s Thought Leadership

Many in our movement have been inspired by Kevin Freeman, a leading advocate for economic freedom. His groundbreaking book, Pirate Money: Discovering the Founders’ Hidden Plan for Economic Justice and Defeating the Great Reset, presents a compelling case for restoring gold and silver as true currency.

A Simple Solution for

Economic Freedom

Freeman's insights reveal how gold and silver were central to the Founders' vision for financial stability. By promoting a return to Constitutional Currency, his work has galvanized efforts to create a more just and stable economic future.

Advancing the Cause of Constitutional Currency

Thanks to Freeman’s research and advocacy, we continue to champion strong, reliable money principles—empowering individuals, strengthening financial independence, and pushing back against economic injustice and instability.

FEATURED POSTS

Wyoming Explores Accepting Gold & Silver as Payment for State ...

Wyoming’s Precious Metals Tax Policy: A Blueprint for ...

Frequently Asked Questions

What is this?

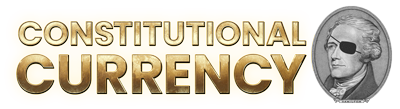

By using existing debit card technology, users can seamlessly make everyday purchases or pay bills with gold or silver.

Participation is optional. It is just another safe, secure way to pay!

Why is this important?

Inflation is hurting many these days, and they are looking for solutions. Gold and silver have been a stable source of currency for centuries. They are the fairest form of money acting as a natural hedge against inflation.

This is your opportunity to help bring Wall Street-level diversification to everyday Americans. You no longer need to be rich to own gold and silver.

Legislation gives the Treasurer or Comptroller of a state authority to monetize and democratize the owning and spending of gold or silver as legal tender. This is optional like other modern payment system, but helps people preserve their buying power.

Is this a brand-new concept? Has it been done before?

Most require gold to be held in Switzerland. We think it would be great for you to have your gold and silver in YOUR STATE!

You can watch this one-minute explainer video to see how it works.

Bringing it to the States offers both practical and legal advantages.

Isn’t this just another crypto or digital currency with all its complications?

The difference is this card is linked to your gold and silver held in a state-authorized secure vault.

Now you can spend gold and silver as legal tender electronically anywhere that accepts MasterCard (or an equivalent payment processing system.)

Is this equitable or just another way for the rich to get richer? How can the average person use it when they cannot afford to get in?

Anyone can easily participate; in fact, they can buy as little as a few dollars worth of gold or silver.

We’ve seen the success of commercial versions such as GlintPay, and they have very low minimums, sometimes below the minimum required for a checking account.

Is it complicated to do?

Anyone who wants to participate can do so by simply opening an account at the state's bullion depository. It would be similar to opening a bank account.

This seems too good to be true. What is the catch? Is there some organization that is pushing this to make private money on it?

The state can choose to generate significant revenue from transaction fees - already paid by merchants, storage, and conversion fees.

The legislators seeking passage of this bill want to see all their state as well as their constituents benefit.

What if depositors want physical possession of their own gold?

Texas, for example, already has a Bullion Depository. Other states might opt to utilize the Texas depository, state-chartered banks, another facility, or eventually establish their own state depositories when it becomes financially viable.

What kind of things can you purchase with this new instrument of the Bullion Depository, this new way to pay?

The credit card companies will convert it on the fly just as they do Dollars, Pounds, and Euros. Merchants will be able to accept this form of payment, as they do now with other debit and credit cards.

This is "just another way to pay" anywhere in the world.

Does this mean that a State will need to buy gold or silver to back this currency?

This gold or silver will be owned by the individuals, businesses, or legal entities. The value of the gold held on deposit in their segregated gold account is the amount that can be spent via their GOLD/SILVER debit card.

Will there be tax implications?

Once gold and silver become transactional, it is easily spent, enabling users to enjoy all the advantages of owning gold or silver while also providing a secure method for making payments.

For many, it will be the first time they have had access to gold and silver along with the easy ability to spend it.

Upon passage, be sure to check with a professional tax advisor or accountant to determine any tax implications. We believe there may not be capital gains or losses when using gold and silver as tender. In fact, some aspects regarding tax implications can be addressed within the legislation.

Is this legal?

For instance, the Texas Bullion Depository is sanctioned under Texas Government Code Section 2116, which includes various supportive provisions (https://statutes.capitol.texas.gov/Docs/GV/htm/GV.2116.htm).

Multiple rulings by the U.S. Supreme Court have upheld this right of the states.

What if the price of gold or silver goes down?

Similarly, the US dollar also faces risks and fluctuates in value compared to other currencies and goods and services. The U.S. dollar has lost 98% of its purchasing power since 1971 when it was removed from the gold standard, but gold has maintained its value...making it a natural hedge against inflation.

We believe it is advantageous to have the option of using gold or silver for transactions alongside paper money.

.jpg)